Expert Options Trading Strategies for Profit

There are various strategies that independent investors can use to generate income and maximize their position in the market. One such strategy is the Long Call, which offers an opportunity for potential high returns. In this section, we will delve into the concept of the Long Call strategy, its associated risks and benefits, and how it can be effectively implemented to enhance your trading portfolio.

Before we dive into the specifics, it is important to understand the basic premise of the Long Call strategy. Essentially, a Long Call involves purchasing call options on a particular stock or asset, granting the holder the right to buy a specified number of shares at a predetermined price (known as the strike price) within a given timeframe. This strategy is particularly attractive to investors who anticipate the price of the underlying asset to rise significantly.

However, it is important to note that like any investment strategy, the Long Call comes with its own set of risks. While the potential for high returns is enticing, investors must be prepared for the possibility of losing their entire investment if the price of the underlying asset does not exceed the strike price within the specified timeframe. Therefore, it is crucial to thoroughly analyze the market conditions, conduct thorough research, and consult with experts before making any investment decisions.

One advantages of the Long Call strategy is its flexibility. Investors have the option to close their positions at any time before the expiration date, allowing them to lock in profits or limit potential losses. Additionally, the Long Call strategy can be used in conjunction with other options trading strategies to further enhance the potential for generating income.

Covered Call

Covered Call strategy, you will need to conduct thorough research and analysis to determine the most appropriate options to trade. It is crucial to work closely with your broker and consult with experts in order to make informed decisions.

The basic concept of a Covered Call is to sell a call option on an equity that you already own. By doing so, you generate income from the premium received for selling the option. If the price of the equity finishes below the strike price of the call option, you get to keep the premium as profit. However, if the price rises above the strike price, your equity may be called away, resulting in potential losses.

One of the advantages of the Covered Call strategy is that it can help offset the cost of buying the equity in the first place. By selling the call option, you receive a premium that can help reduce the initial investment cost. Additionally, it provides a level of downside protection, as the premium received can act as a cushion against potential losses.

Let’s say you own 100 shares of Johnson & Johnson, which is currently trading at $150 per share. You believe that the price will remain relatively stable over the next few months, and you’re looking to generate some additional income from your investment. You decide to sell a Covered Call option on your Johnson & Johnson shares with a strike price of $160 and an expiration date three months from now. By doing so, you receive a premium of $3 per share, totaling $300.

If the price of Johnson & Johnson stays below $160 at the expiration date, you get to keep the premium as profit. However, if the price rises above $160, your shares may be called away, and you would miss out on any potential gains above that price.

Exploring the Long Put Strategy

The Long Put strategy involves the purchase of put options, which gives the trader the right, but not the obligation, to sell a specified number of stocks at a predetermined price within a certain time frame. By buying put options, traders can profit from a decline in the price of the underlying stock. If the stock price falls below the strike price of the put option, the trader can sell the stock at a higher price, resulting in a profit.

Once a suitable broker is selected, traders can initiate a Long Put position by purchasing put options on a stock they believe will experience a decline in price. The number of put options and the strike price should be determined based on the trader’s analysis and risk tolerance.

As the stock price falls, the value of the put options rises, allowing the trader to profit from the trade. However, if the stock price rises or remains above the strike price, the trader may experience a loss on the trade.

The Importance of Research and Disclosure

As with any investment strategy, it is crucial to conduct thorough research and analysis before implementing the Long Put strategy. Traders should review the company’s financial statements, market trends, and any relevant news or events that could impact the stock’s price.

Additionally, it is important to disclose any potential conflicts of interest or affiliations that may influence the trader’s decision-making process. Maintaining integrity and transparency is essential in building trust with investors and ensuring the best possible outcomes.

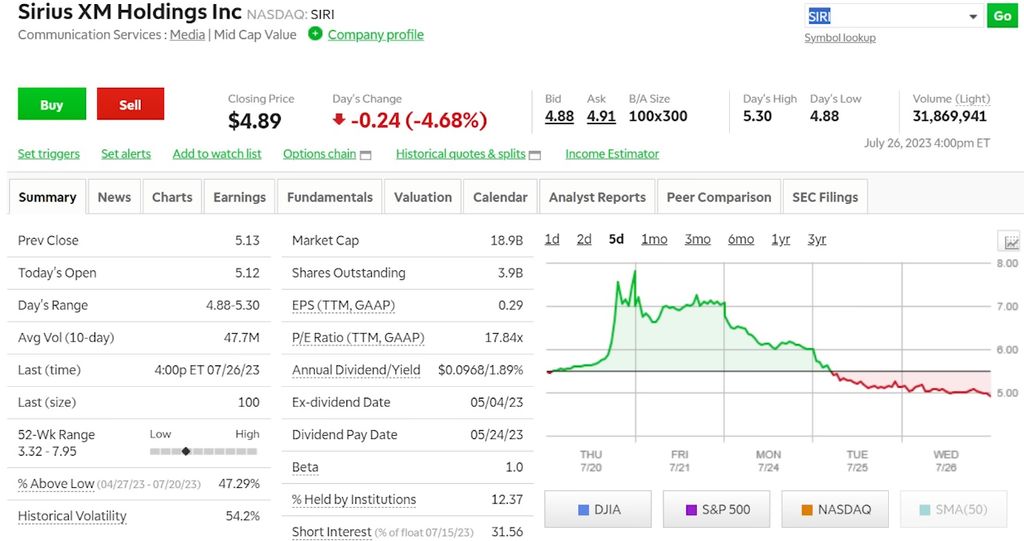

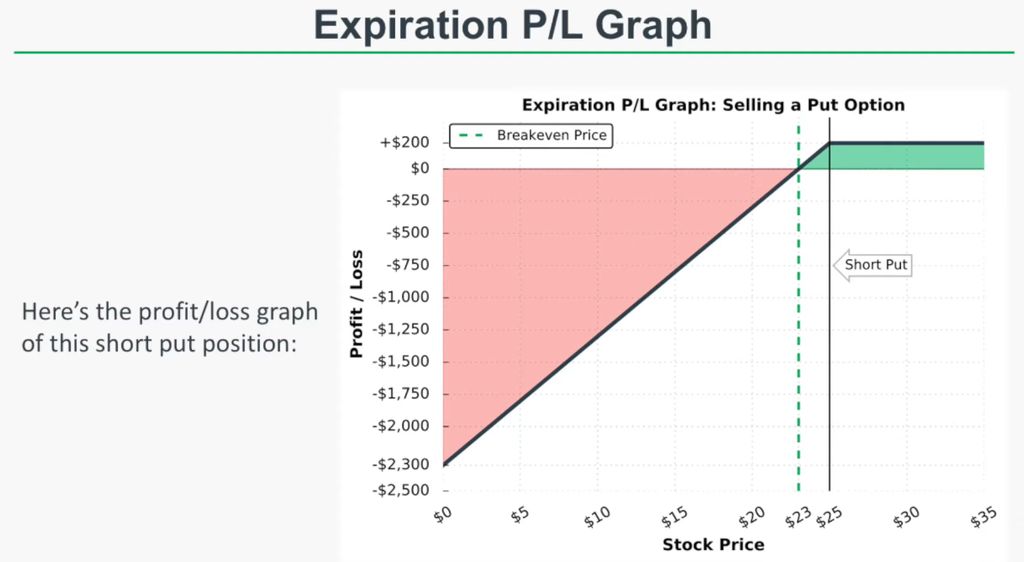

Short Put: A Safer Strategy for Options Traders

When it comes to options trading, there are various strategies that investors can utilize to maximize their profits or minimize their losses. One such strategy that can be particularly useful for beginners is the Short Put strategy. This approach involves selling a put option with the expectation that the underlying stock will either rise or stay above a certain price level, known as the strike price, by the time the option expires.

While the Short Put strategy can be a safer alternative compared to other options trading strategies, it still carries some risks. If the stock price falls significantly below the strike price, the seller of the put option could face substantial losses. Therefore, it’s crucial for traders to assess the risk-reward ratio and carefully select the strike price and expiration date that align with their risk tolerance and market expectations.

Implementing the Short Put Strategy

To implement the Short Put strategy, traders need to have a margin account with a trusted broker. This type of account enables traders to sell options and maintain the necessary collateral in case the option is exercised. It’s important to note that selling options in a cash account is prohibited by most brokers.

When selecting the strike price, traders should consider their market outlook and the level at which they would be comfortable buying the underlying stock. Additionally, they should strive to find a balance between generating a sufficient premium and managing the associated risks.

| Benefits | Risks |

|---|---|

| Generate upfront income | Potential for substantial losses if the stock price falls significantly |

| Opportunity for consistent income generation | Obligation to buy the underlying stock at the strike price if the option is exercised |

| Can be a safer strategy compared to other options trading approaches | Requires careful assessment of risk-reward ratio and market expectations |

Married Put

The married put strategy is a type of options trading strategy where an investor purchases both shares of stock and put options on those shares. By doing so, they have the right to sell the stock at a predetermined price (known as the strike price) within a specified time frame. This strategy helps protect against potential losses in the stock market while allowing for potential gains if the stock price increases.

Let’s say you own 100 shares of Facebook stock, which is currently trading at $200 per share. You are concerned about a potential decline in the stock’s value but still want to hold onto your shares for future gains. In this case, you could purchase a put option with a strike price of $190, giving you the right to sell your shares at that price.

If the stock price drops below $190, your put option becomes valuable, as it allows you to sell the shares at a higher price than the current market value. This helps offset any losses you may experience in the stock market. On the other hand, if the stock price increases, you can simply let the put option expire and continue to hold onto your shares.

Benefits of the Married Put Strategy

The married put strategy offers several benefits:

- Protection against potential losses: By purchasing put options, you can limit your downside risk in case the stock price decreases.

- Potential for gains: If the stock price increases, you can still benefit from the upside potential.

- Flexibility: You have the option to sell your shares at the strike price, but you can also choose to hold onto them if the stock performs well.

- Cost-effective: The cost of buying put options is generally lower than selling the stock and buying it back later.

- Verified strategy: The married put strategy is a well-established and widely used approach in the options trading world.

The Bankrate Promise

At Bankrate, we understand the importance of providing reliable and unbiased information to investors of all levels. That’s why we strive to offer a comprehensive guide that covers various options trading strategies for beginners. In this section, we will discuss the Bankrate Promise and how it ensures that our readers can make informed investment decisions.

1. Independent Research and Expert Analysis

Bankrate’s team of expert writers and researchers, including Professor Brian Johnson, thoroughly analyze various trading strategies and provide unbiased insights. Our independent approach allows us to offer a diverse range of perspectives, ensuring that you have access to a wealth of knowledge when making investment decisions.

2. Total Transparency and Disclosure

When it comes to investing, transparency is key. Bankrate is committed to providing clear and thorough information about each trading strategy discussed. We disclose the potential risks, costs, and expected outcomes, ensuring that you have a complete understanding of what each strategy entails.

Our dedicated staff of editors and writers work diligently to ensure that our content is accurate and up-to-date. We take pride in our high editorial standards, providing you with reliable information that you can trust.

3. The Bankrate Guarantee

Bankrate stands behind the information we provide. We guarantee that the strategies discussed in this guide have been thoroughly researched and analyzed by our experts. While investing always involves some level of risk, we aim to offer strategies that have shown past success and have the potential to generate positive returns.

| Bankrate Promise Highlights: |

|---|

| Independent research and expert analysis |

| Total transparency and disclosure |

| The Bankrate guarantee |

FAQ:

How do I trade options?

Trading options involves buying or selling contracts that give you the right, but not the obligation, to buy or sell an underlying asset at a specific price within a certain time frame. To trade options, you need to open an options trading account with a brokerage firm, learn about different strategies, and understand the risks involved.

How much money do I need to trade options?

The amount of money you need to trade options varies depending on the brokerage firm and the specific options trading strategy you plan to use. Some brokers may have minimum deposit requirements, while others may require a certain amount of capital to execute certain strategies. It is recommended to have a sufficient amount of capital to cover potential losses and meet margin requirements.

What is a long call strategy?

A long call strategy is an options trading strategy where an investor buys call options with the expectation that the price of the underlying asset will rise. By purchasing call options, the investor has the right to buy the asset at a predetermined price (strike price) within a specified time period. This strategy allows the investor to profit from an increase in the price of the underlying asset.

What is a covered call strategy?

A covered call strategy is a conservative options trading strategy where an investor who owns the underlying asset sells call options against it. By selling call options, the investor collects premium income, which provides a limited downside protection. If the price of the underlying asset remains below the strike price of the call options, the investor keeps the premium income and can continue to sell more call options.

What is a short put strategy?

A short put strategy is an options trading strategy where an investor sells put options with the expectation that the price of the underlying asset will rise or remain stable. By selling put options, the investor collects premium income and has the obligation to buy the underlying asset at a predetermined price (strike price) if the option is exercised. This strategy is often used when the investor is bullish on the underlying asset.

How do I trade options?

To trade options, you need to open a brokerage account and have a basic understanding of how options work. You can then choose from various options trading strategies, such as long call, long put, covered call, short put, and married put, depending on your investment goals and risk tolerance. It is recommended to educate yourself about options trading and seek guidance from experienced professionals before getting started.