10 Options Strategies to Know: Guide for Traders

Firstly, let’s explore the butterfly strategy. This unique approach involves the purchase of both in-the-money and out-of-the-money options with the same expiration date. By doing so, the trader essentially creates a “winged” position that profits if the underlying asset settles at a specific price. The butterfly strategy is ideal for those who believe that the price movement will be limited in a particular direction.

Next, let’s discuss the covered straddle strategy. This strategy involves selling a call and a put option on the same underlying asset, with the same expiration date and strike price. By doing so, the investor becomes obligated to buy the underlying asset if it falls below the strike price or to sell it if it rises above the strike price. This strategy is often used to protect against losses or generate additional income.

Another key strategy to consider is the condor. This strategy involves buying and selling four different options with the same expiration date but different strike prices. By doing so, the trader aims to profit from a small movement in the underlying asset’s price. The condor strategy is particularly useful when the investor believes that the price will remain within a specific range.

Lastly the married put strategy. This bearish strategy involves the purchase of a put option on an underlying asset that the investor already owns. By doing so, the investor gains the advantage of protecting their position from further losses if the price of the underlying asset declines. The married put strategy is often used by investors who wish to limit their downside risk while still participating in potential upside gains.

Covered Call: A Strategy for Generating Income in the Stock Market

Generating income in the stock market is a goal for many traders. One effective strategy for achieving this is the covered call. This strategy involves writing call options on stocks that you already own, allowing you to collect premiums and potentially earn additional income.

When implementing the covered call strategy, suppose a trader owns a certain stock. They can then write call options on that stock, giving someone else the right to buy it at a specified price (known as the strike price) within a certain timeframe. In return for granting this right, the trader receives a premium.

The advantage of the covered call strategy is that it allows traders to generate income from their existing stock holdings. By writing call options, they can collect premiums without having to sell their stocks outright. This strategy can be especially useful in sideways or slightly bearish markets, where stock prices may not move significantly in either direction.

One key aspect of the covered call strategy is that it provides a limit to potential gains. If the stock price rises above the strike price, the trader may be obligated to sell their stocks at that price, missing out on potential profits. However, if the stock price remains below the strike price, the trader can keep the premium and continue holding onto their stocks.

- The covered call strategy involves writing call options on stocks that a trader already owns.

- By writing call options, traders can collect premiums and potentially earn additional income.

- The covered call strategy provides a limit to potential gains but also acts as a protective measure against potential losses.

- This strategy can be particularly useful in sideways or slightly bearish markets.

- Understanding the trade-offs and key aspects of the covered call strategy is crucial for successful implementation.

Married Put: A Protective Strategy for Stock Investors

The Married Put strategy involves buying a put option for the same number of shares of a particular stock that the investor currently holds. By purchasing the put option, the investor has the right, but not the obligation, to sell the stock at a predetermined price within a specified time frame. This strategy helps to limit potential losses in case the stock price declines.

When the investor buys a put option, they essentially create a protective “floor” for their stock. If the stock price falls below the predetermined price, the investor can exercise the put option and sell the stock at that price, thereby minimizing their losses. This strategy is particularly useful for bullish investors who want to protect their assets in case the market turns bearish.

One advantage of the Married Put strategy is that it allows investors to participate in the potential upside of the stock while also providing downside protection. If the stock price increases, the investor can still benefit from the price appreciation. On the other hand, if the stock price declines, the investor is protected by the put option.

It’s important to note that the Married Put strategy involves the purchase of both the stock and the put option, which requires a certain amount of capital. Investors should carefully consider the cost of implementing this strategy and ensure that it aligns with their investment goals and risk tolerance.

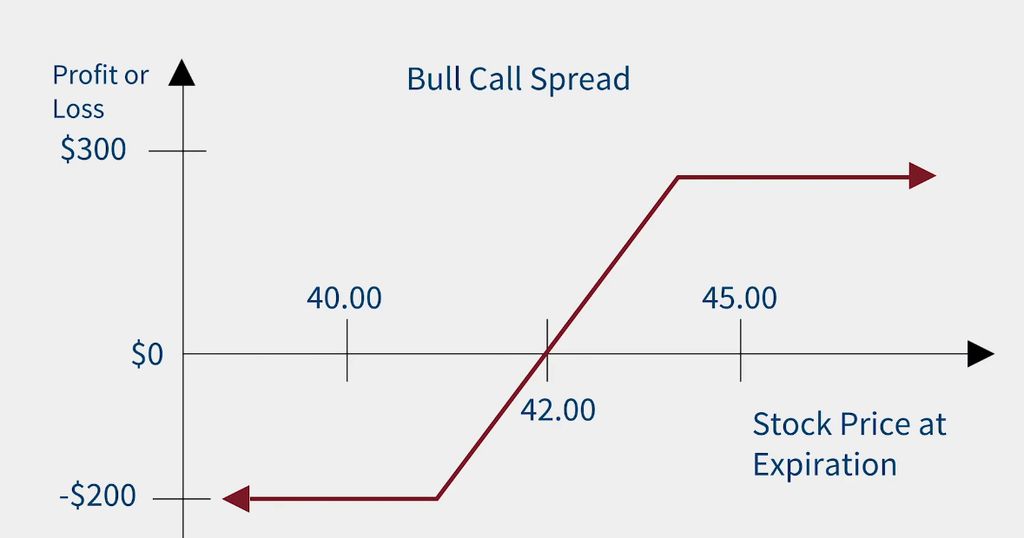

Bull Call Spread: Profiting from a Moderate Increase in Stock Price

In a Bull Call Spread, the trader buys a call option with a lower strike price and simultaneously sells a call option with a higher strike price. By doing so, the trader creates a spread, or a range of prices within which they can profit. The Bull Call Spread strategy is ideal for bullish market conditions, where the trader anticipates the stock price to increase. It can also be effective in sideways markets, where the stock price remains relatively stable.

Suppose a trader purchases a call option with a strike price of $100 for a premium of $3. Simultaneously, they sell a call option with a strike price of $110 for a premium of $1. This creates a spread with a net debit of $2. If the stock price increases and reaches $110 or higher, both options will be in-the-money. However, since the trader sold the higher strike call option, they will be obligated to sell the stock at $110 upon exercise. On the other hand, if the stock price remains below $100, both options will be out-of-the-money, and the trader will lose the small premium paid for the spread.

Bear Put Spread: Taking Advantage of a Downtrending Stock Market

When the stock market is experiencing a decline, traders often look for strategies that allow them to profit from this downward movement. One such strategy is the Bear Put Spread, which involves the trade-off between potential gains and limited risk.

A Bear Put Spread is a combination of buying and selling put options on the same underlying stock with different strike prices. The trader buys a put option with a higher strike price and sells a put option with a lower strike price. This strategy creates a box-like structure that allows the trader to profit if the stock price declines.

In a Bear Put Spread, the trader aims to capitalize on a declining stock market by taking a bearish position. By buying a put option with a higher strike price, they have the right to sell the stock at that price, protecting their assets from further decline. On the other hand, by selling a put option with a lower strike price, they receive a premium, reducing the overall cost of the trade.

The maximum profit for a Bear Put Spread occurs when the stock price is below the lower strike price at expiration. In this scenario, both the long put and the short put are in the money, resulting in the maximum value of the spread. However, if the stock price rises above the higher strike price, the maximum loss is limited to the initial cost of the spread.

- The Bear Put Spread is a strategy used by traders to profit from a declining stock market.

- It involves buying a put option with a higher strike price and selling a put option with a lower strike price on the same underlying stock.

- The strategy provides a trade-off between potential gains and limited risk.

- The maximum profit occurs when the stock price is below the lower strike price at expiration, while the maximum loss is limited to the initial cost of the spread.

- By employing the Bear Put Spread strategy, traders can take advantage of a bearish market while also protecting their assets from further decline.

Protective Collar: Safeguarding Your Investments from Market Volatility

In this section, we will explore a strategy called the protective collar, which can help traders protect their investments from market volatility. This strategy involves the simultaneous purchase of a put option and the sale of a call option on the same underlying asset. By doing so, the trader can limit their downside risk while still participating in any potential upside movement.

Understanding the Protective Collar Strategy

The protective collar strategy is often used by investors who are bullish on an underlying asset but want to protect themselves against a potential decline in its price. By purchasing a put option, the trader has the right to sell the asset at a predetermined strike price, which provides a limit to their potential losses. On the other hand, by selling a call option, the trader generates income and offsets the cost of purchasing the put option.

The protective collar strategy is executed by selecting out-of-the-money options, where the strike price of the put option is lower than the current market price of the asset, and the strike price of the call option is higher than the current market price. This allows the trader to make a profit if the price of the asset remains within a certain range.

Key Takeaways of the Protective Collar Strategy

| 1. | The protective collar strategy protects the trader’s investments from market volatility. |

| 2. | It involves the purchase of a put option and the sale of a call option on the same underlying asset. |

| 3. | The strategy is executed using out-of-the-money options. |

| 4. | By purchasing a put option, the trader limits their potential losses. |

| 5. | By selling a call option, the trader generates income to offset the cost of the put option. |

| 6. | The trader’s potential profits are limited if the price of the asset moves beyond a certain range. |

| 7. | The protective collar strategy is suitable for investors who are bullish on an asset but want to protect against price declines. |

| 8. | It can be used to safeguard a portfolio of assets or individual positions. |

Long Straddle: Capitalizing on Significant Price Swings

When it comes to trading options, the long straddle strategy is a powerful tool that allows investors to take advantage of substantial price movements in the market. By purchasing both a call option and a put option with the same strike price and expiration date, traders can protect themselves against potential losses while potentially earning substantial profits.

The long straddle strategy is particularly useful in volatile market conditions, where significant price swings are expected. By buying both a call and a put option, traders are not limited to the direction in which the market moves. Whether the stock price goes up or down, the long straddle strategy allows investors to profit.

Here’s how it works:

- Investors buy a call option, which gives them the right to buy the underlying stock at a specific price, known as the strike price.

- Investors also buy a put option, which gives them the right to sell the underlying stock at the strike price.

- If the stock price rises above the strike price, the call option becomes profitable, allowing investors to make gains.

- If the stock price declines below the strike price, the put option becomes profitable, generating profits for the investors.

- The maximum loss for the long straddle strategy is limited to the premium paid for both options.

- Traders can close their positions at any time before the options expire by selling their call and put options.

- If the stock price remains relatively stable and doesn’t move significantly, the long straddle strategy may result in a loss as the value of the options decreases over time due to time decay.

- However, if a significant price movement occurs, the long straddle strategy can generate substantial profits.

- One key consideration when implementing the long straddle strategy is the cost of buying both options. Traders need to carefully assess whether the potential gains outweigh the initial investment.

- Another important factor to consider is the time remaining until the options expire. The longer the time until expiration, the greater the chances of a significant price movement and the potential for profits.

Profiting from Large Price Movements: The Long Strangle Strategy

The Long Strangle strategy involves writing both out-of-the-money put and call options on a particular stock or asset. By doing so, the investor creates a position that profits from a substantial price movement in either direction. This strategy is best utilized when the investor believes that the market will experience significant volatility, but is uncertain about the direction of the movement.

The Long Strangle strategy is composed of two key components: buying out-of-the-money puts and buying out-of-the-money calls. The investor is not obligated to exercise these options, but rather uses them as a means to profit from the anticipated price movement. This strategy allows the investor to benefit from a large price swing, regardless of whether the market moves up or down.

How the Long Strangle Works

Let’s consider an example to understand the Long Strangle strategy better. Jared, an experienced trader, believes that a particular stock is about to experience a significant price movement. However, he is uncertain about the direction of the movement. In such a scenario, Jared can implement a Long Strangle strategy to maximize his potential profits.

Jared writes out-of-the-money put options with a strike price below the current stock price, giving him the right to sell the stock at a higher price if it declines. Simultaneously, he also writes out-of-the-money call options with a strike price above the current stock price, giving him the right to sell the stock at a lower price if it rises.

If the stock price remains relatively stable or moves within a narrow range, both the put and call options will expire worthless, resulting in a loss for Jared. However, if a significant price movement occurs in either direction, Jared stands to make a profit. The wider the width of the spread between the strike prices of the put and call options, the greater the potential profit.

Long Call Butterfly Spread: Achieving Balance in Options Trading

The Long Call Butterfly Spread involves buying and selling a combination of call options with different strike prices and expiration dates. By executing this strategy, traders can create a range of possible outcomes based on the movement of the underlying stock.

Here’s how it works: a trader purchases a call option with a lower strike price and sells two call options with a higher strike price. These options are all executed on the same underlying stock and have the same expiration date. The trader also buys another call option with an even higher strike price, which serves as a protective measure.

The key to the Long Call Butterfly Spread is the balance it provides. If the stock price remains within a certain range, the trader can maximize their profit potential. However, if the stock price moves too far in either direction, the losses are limited due to the protective call option.

| Key Points |

|---|

| 1. The Long Call Butterfly Spread involves buying and selling call options with different strike prices and expiration dates. |

| 2. This strategy allows traders to take advantage of market movements while protecting against potential losses. |

| 3. The balance in this strategy is achieved by buying a protective call option with a higher strike price. |

| 4. The Long Call Butterfly Spread is ideal for traders who anticipate limited movement in the underlying stock. |

| 5. The maximum profit potential is achieved when the stock price is at the middle strike price at expiration. |

| 6. This strategy is also known as the Butterfly Spread or the Iron Butterfly. |

| 7. The Long Call Butterfly Spread is a defined risk strategy, as the potential losses are limited. |

| 8. Traders can adjust the width of the spread to increase or decrease risk and potential profit. |

| 9. This strategy can be used in both bullish and bearish market conditions. |

| 10. The Long Call Butterfly Spread is a versatile strategy that allows traders to generate income while managing risk. |

FAQ:

What is a box spread?

A box spread is an options strategy that involves buying a bull call spread and a bear put spread with the same strike prices and expiration dates. It is used to take advantage of arbitrage opportunities and can result in risk-free profits.

What is a calendar spread?

A calendar spread is an options strategy that involves buying and selling options with the same strike price but different expiration dates. It is used to take advantage of time decay and can profit from a neutral or slightly directional market outlook.

Are protective puts a waste of money?

No, protective puts are not necessarily a waste of money. They can be used as a form of insurance to protect against potential losses in a stock position. While they do have a cost, the protection they provide can be valuable in certain market conditions.

Which options strategies can make money in a sideways market?

Options strategies that can make money in a sideways market include the iron condor, the long strangle, and the long call butterfly spread. These strategies take advantage of limited volatility and can profit from a lack of significant price movement in the underlying asset.

What are the key takeaways from the article?

The key takeaways from the article are: 1) There are various options strategies that traders can use to enhance their trading strategies. 2) A box spread involves buying a bull call spread and a bear put spread. 3) A calendar spread involves buying and selling options with the same strike price but different expiration dates. 4) Protective puts can provide insurance against potential losses. 5) The iron condor, long strangle, and long call butterfly spread are options strategies that can profit in a sideways market.